I just got done cutting my hair, and while I was in the shower afterward, I thought of Great Decision #4 -- Buying my own hair clippers.

Back during my time at my first job after graduate school, I was poor -- way poor. My rent was more than I could afford and paying back my debt was taking nearly ALL of my salary, post-bills. Part of this was that I was being paid crap and part was because I still had not managed to get my spending under control.

Anyway, one day back in December 2004, I decided that a great way to save money was to start cutting my own hair. All through grad school, I was being cheap, by going to SuperCuts. There was one close to my apartment and one across the street from school. Initially, a haircut would cost me about $12-15. I could walk over when I had downtime between experiments or during lunch or whatever, and that was just fine. But over the years, the cuts got more and more expensive. I think my last one was $25. I only cut my hair every 4-6 months, so we're only talking about $50-120/year. It's not THAT big of a deal.

However, my situation had become so pathetic, that come the end of 2004, I was looking for ANYTHING that could possibly save me money. On my way home from work one day, I had this thought. I need a haircut. But why pay $25 for one haircut, when I could potentially do it myself for cheaper. I got a couple of friends to come over, one of whom cut his own hair for quite some time, and I went to Target and bought my very own hair clippers for about $25. My buddy EO cut my hair for me in my bathroom, and not only did she do a great job, we had a blast. I think that her boyfriend even cut his own hair, but I may be remembering that wrong.

Anyway, ever since, I've been cutting my own hair. I have been able to do it myself and get cuts about as good as SuperCuts, for FREE! Sure, sometimes, I frak it up and look like ass for a few weeks while it grows out, but it's just hair; it does grow back. It's now nearly five years later, and I still have not paid for a hair cut since.

It's been great on days (like today), when I come home and am very annoyed with my hair, and I just say, "Today, Hair, you're going DOWN!" And I just cut it all off (I pretty much shaved it all off today, but I have cut with more style in the past). Plus, I get to just hop right in the shower afterward and wash all those irritating, itchy loose hairs right off, instead of having to go around for the rest of the day being irritated.

Plus, over the past year, I've cut a friend of mine's hair several times. So, not only am I getting free hair cuts, my friends can too. Granted, this works mainly because I'm a boy, and I'm not terribly picky about my hair. There are those out there that would rather just suck it up and pay to have a pro coif his or her mop. But for me, this has be absolutely great.

So, to recap... $25 for hair clippers at Target = 5 years of free haircuts (and probably many more to come; that sucker is still going strong). OOH! And I totally forgot! I also use it to trim down my beard. That's another thing I started doing at that time. Instead of forking over $15-20 per pack of razors and shaving gel, I'd just trim the bushy face down to a uniform layer of stubble -- FOR FREE! Personally, I think I look better with stubble, but what do I know? And yes, sometimes, I just have to shave it all off and be smooth. But I have drastically reduced the amount of money that I spend on shaving supplies. I really only buy razors about once a year (for a 4 pack), and that works great.

So yeah, buying my own hair clippers. EXCELLENT FINANCIAL DECISION!

Friday, September 25, 2009

Wednesday, September 23, 2009

Found Cash!

I totally forgot the excitement of yesterday!

I found my bag of rolled coins that I (and friends of mine) had rolled a long time ago. There was $45 in dimes, nickels, and pennies. And I deposited it all into my checking account. Of course, my friend at BofA was annoyed, but it was great to get that change out of my apartment and back into circulation. WOO.

Even more exciting is that I have a my change jug still with TONS of change in it. I'm really looking forward to rolling and depositing that! =)

I found my bag of rolled coins that I (and friends of mine) had rolled a long time ago. There was $45 in dimes, nickels, and pennies. And I deposited it all into my checking account. Of course, my friend at BofA was annoyed, but it was great to get that change out of my apartment and back into circulation. WOO.

Even more exciting is that I have a my change jug still with TONS of change in it. I'm really looking forward to rolling and depositing that! =)

Great Financial Decisions in DelMoniq History #3 - Takinng out Student Loans

These decisions aren't really in any particular order (other than the order in which I thought of them), so now we're going to take a little trip back in time and talk about student loans.

I mentioned a while back about my college years and how my parents were really awesome in paying for pretty much my entire undergraduate experience. So, there were no loans or anything from that time. What there was though was a crap-ton of credit card debt from my wonderful "pay for it later when I have a real job" attitude.

So, I graduated, moved across the country, and started graduate school. Again (I don't know how I keep doing this, but whatever), I lucked into an awesome situation. Two of my good friends from undergrad moved to the same city the year before I was moving there. They rented a two-bedroom apartment together. During my week-long drive cross-country with my dad (and two cats), one of my friends called me (I had been planning on staying with them while I found my own place) and said that the other friend was moving to Japan to teach English for a year or so. And she asked me if I wanted to take over her half of the apartment. YAY! I had a place to live AND an awesome roommate, and I had not even made it into the state yet. Okay, if I don't speed this up, I'll be writing a novel before I get to the point.

The point of the apartment story was that I lucked into a really cheap living situation in a really expensive city ($400/month, which dropped when we took on a 3rd roommate later on). During grad school, I kept up my frivolous college spending habits, and my credit card debt kept rising. (I could side note here another great decision involving Best Buy, my best friend, a bunch of martinis, and $2000, but I'll save that for later.)

Eventually (probably in my 3rd year), I hit the wall. My spending had maxed out my limits. My credit was GONE, and I couldn't get any more cards. I think that at the peak of my horrible-ness, I had 7 or 8 cards plus a Dell computer account. What's that you say? Where did my pay check go? Well... there was rent, food, and pretty much the rest of it went to paying the credit card payments. Pretty much, I was broke and barely keeping my head above water. And (not really learning my lesson yet at this point) once a card got paid down enough, I would just buy more crap or whatever and BOOM, card was maxed out again.

One day, my best friend, MsK (same from the Best Buy story) had a brilliant idea; she was in similar situation to myself; however, it was more dire for her. She lived alone and had her utilities cut off more than once (luckily, she's much better now). Her idea: take out student loans. Wha...????

Student loans are available to graduate students (like both me and MsK were at the time), and have a MUCH lower interest rate than credit cards. So, our plan was to take out the loans, which we didn't need for paying for school, and use them to pay off credit cards. The beauty of this was that this got the debt to go away, AND it put it all into a much "better" debt of the student loan, which would not require payments or accrue interest until we were out of school, which turned out to be another 3.5 years (for me).

The plan was GENIUS! With a few exceptions. (1) I couldn't be trusted with $5000 cash at one sitting and (2) I ended up moving a couple of times. So, here's what happened. Yes, a bulk of the credit card debt got paid off with student loans. But, not all of the loans were used to pay off credit card debt. I would venture to say that about half of the loans went to debt, and the other half was spent on buying stuff and moving expenses.

Overall, this was a GREAT decision. I wish that I had handled it a bit better, and paid off more debt with it AND that I was able to keep myself from USING the paid off cards. But all in all, I was able to pay down lots of debt, and get myself in a much better place financially for the next few years.

Now, I have been paying off the loans since 2004, which basically means I've been paying interest. And it isn't that bad. I've had ups and downs financially since then, and I am still working on getting all my other more pressing sources of debt (Taxes, credit cards, CitiLoan) paid off before majorly tackling the student loan. I just checked online, and my total student loan at this point is $39,254.02.

**shudder**

But I have faith that once my CitiLoan is gone and the credit cards are gone and the taxes are paid (not in that order, mind you) that I will be able to get this debt gone as well. Luckily, student loan interest is tax deductible.

I am a LONG way off from being 100% debt free, but taking out the student loans was definitely a GOOD idea. I just need to curb my spending and just keep plugging away.

I mentioned a while back about my college years and how my parents were really awesome in paying for pretty much my entire undergraduate experience. So, there were no loans or anything from that time. What there was though was a crap-ton of credit card debt from my wonderful "pay for it later when I have a real job" attitude.

So, I graduated, moved across the country, and started graduate school. Again (I don't know how I keep doing this, but whatever), I lucked into an awesome situation. Two of my good friends from undergrad moved to the same city the year before I was moving there. They rented a two-bedroom apartment together. During my week-long drive cross-country with my dad (and two cats), one of my friends called me (I had been planning on staying with them while I found my own place) and said that the other friend was moving to Japan to teach English for a year or so. And she asked me if I wanted to take over her half of the apartment. YAY! I had a place to live AND an awesome roommate, and I had not even made it into the state yet. Okay, if I don't speed this up, I'll be writing a novel before I get to the point.

The point of the apartment story was that I lucked into a really cheap living situation in a really expensive city ($400/month, which dropped when we took on a 3rd roommate later on). During grad school, I kept up my frivolous college spending habits, and my credit card debt kept rising. (I could side note here another great decision involving Best Buy, my best friend, a bunch of martinis, and $2000, but I'll save that for later.)

Eventually (probably in my 3rd year), I hit the wall. My spending had maxed out my limits. My credit was GONE, and I couldn't get any more cards. I think that at the peak of my horrible-ness, I had 7 or 8 cards plus a Dell computer account. What's that you say? Where did my pay check go? Well... there was rent, food, and pretty much the rest of it went to paying the credit card payments. Pretty much, I was broke and barely keeping my head above water. And (not really learning my lesson yet at this point) once a card got paid down enough, I would just buy more crap or whatever and BOOM, card was maxed out again.

One day, my best friend, MsK (same from the Best Buy story) had a brilliant idea; she was in similar situation to myself; however, it was more dire for her. She lived alone and had her utilities cut off more than once (luckily, she's much better now). Her idea: take out student loans. Wha...????

Student loans are available to graduate students (like both me and MsK were at the time), and have a MUCH lower interest rate than credit cards. So, our plan was to take out the loans, which we didn't need for paying for school, and use them to pay off credit cards. The beauty of this was that this got the debt to go away, AND it put it all into a much "better" debt of the student loan, which would not require payments or accrue interest until we were out of school, which turned out to be another 3.5 years (for me).

The plan was GENIUS! With a few exceptions. (1) I couldn't be trusted with $5000 cash at one sitting and (2) I ended up moving a couple of times. So, here's what happened. Yes, a bulk of the credit card debt got paid off with student loans. But, not all of the loans were used to pay off credit card debt. I would venture to say that about half of the loans went to debt, and the other half was spent on buying stuff and moving expenses.

Overall, this was a GREAT decision. I wish that I had handled it a bit better, and paid off more debt with it AND that I was able to keep myself from USING the paid off cards. But all in all, I was able to pay down lots of debt, and get myself in a much better place financially for the next few years.

Now, I have been paying off the loans since 2004, which basically means I've been paying interest. And it isn't that bad. I've had ups and downs financially since then, and I am still working on getting all my other more pressing sources of debt (Taxes, credit cards, CitiLoan) paid off before majorly tackling the student loan. I just checked online, and my total student loan at this point is $39,254.02.

**shudder**

But I have faith that once my CitiLoan is gone and the credit cards are gone and the taxes are paid (not in that order, mind you) that I will be able to get this debt gone as well. Luckily, student loan interest is tax deductible.

I am a LONG way off from being 100% debt free, but taking out the student loans was definitely a GOOD idea. I just need to curb my spending and just keep plugging away.

Labels:

apartment,

best buy,

friends,

grad school,

parents,

student loan

Monday, September 21, 2009

Great Financial Decisions in DelMoniq History #2 - Moving to a Safer Neighborhood

This minorly ties in with Decision #1, but not obviously and not directly.

Picture it... crappy neighborhood Fall 2008. (Gold Girls reference, sorry, my gay is showing)....

Anyway, when I moved cross-country in 2005, I knew that I wasnt moving into the greatest of cities or the greatest of neighborhoods in said city. But it was good enough, the place was nice and affordable, and I could take public trans (or walk) to work.

Over my first three years here, I saw the neighborhood slowly decline. The people on my street (more importantly my building and neighbors owned by the same people) were moving away, and apartments were vacant for a long time. The people moving in were not of the same caliber as before. People around my age and situation (grad/med school types) were moving out and poorer families with many children were moving in.

Graffiti appeared on the back of our house. Cars in the back lot were broken into. The landlords put up a fence (it helped some, but was kinda retarded as it didnt actually enclose anything). A car was parked across the street for over a week with no one attending it, and eventually, all the windows were busted out of it. Turns out the car was stolen and abandoned on our street.

One night last October, I was playing video games and chilling out at home, and I heard shouting outside. I looked out the window, and saw a car parked in the middle of the street and two guys shouting at each other. I sat back down and played more games. And then, I heard it. Five or six very loud gunshots right outside my house. I looked out the window and saw one of the guys running off down the street.

I grabbed my phone and called 911. Moments later, police and fire trucks were there. I never really learned what happened that night. No one was killed on my street. But the seed had been placed... it was time to move. The police action took hours. People were yelling, police investigated. I heard one woman shout: Oh my god! Thats my sisters car! What the fuck? What happened?.

The next morning, I told my carpool what happened, and one of my friends responded, with oh just last week so and so told me that someone was shot and killed outside her house. That was a block away at the other end of my street!

That morning, I was on the phone with my landlord trying to get out of my lease. They understood. I had just signed a new lease two weeks earlier, so they were sad, but they did let me out of the lease. I promised to be out by December 1.

What followed was a month of hunting for apartments. That was so NOT easy. Maybe my standards are too high? Maybe this city is not that good in general? Eventually, I found a place that I liked; however, I (again) missed warning signs.

I was so focus on getting out of the ghetto and into a decent place, that I missed a few things. Anyway, I did see the apartment, but it was after dark and most of the lights in the place were burned out. As devils advocate, there are no ceiling lights in most of the apartment. But still, I should have insisted on revisiting in the daytime. But I liked the location and the layout, and they would take my cats. So I said I would apply. The rent was a bit more than I wanted to pay, and I did try to get him to come down on the deposit. But he said he wouldnt if I had the cats. UGH.

Anyway, what followed was a month of drama. Where I had rented apartments before (in a different state), there are very strict laws in place that landlords and tenants MUST follow. And everything is very well standardized and thought out. NOT HERE. First off, what I didnt realize at the time, was that I was dealing with a rental company and NOT the landlord. Their only goal is to rent the property for the landlord, collect their commission, and wash their hands of the whole thing. So, when I saw the apartment, I said it was dirty and needed to be cleaned. The rental agent told me that the landlord would have the place cleaned and painted in time for move in. And I agreed.

I had a meeting to sign the lease, but they didnt have the keys. So, I paid money and had NOTHING to show for it. The next day, I got the keys. But it was not ALL of the keys. I was missing a mailbox key and the key to balcony door (which is double keyed, so until I had a key it could not be LOCKED). After several run arounds with the rental people, I finally go in touch with the landlord. And he insisted that the rental people had all the keys. After assuring him that they did not have all the keys, I had to meet with him at his office (an OB/GYN office, very uncomfortable) during the work day to compare my keys with his keys. Turns out he had some keys that he didnt know what they were, and they were my missing keys.

Anyway, I drive up to check on the place during the day (weeks after I was told the place would be cleaned), and it wasnt. Nothing had been done. I talked with the landlord, and he said If I knew it had to be cleaned, I would have charged more for the deposit. What the fuck!?! That charge should have been made against the pigs that moved out of here.

Anyway, I told him that it didnt matter, because I had already rented a truck to move the next day. So on moving day, I rented a carpet shampooer and my friend (the compulsive cleaner) shampooed and vacuumed and scrubbed while us boys moved boxes from the truck.

So, the financial part come in here. At the same time that Im looking for a new place to live, I get my October 2008 paycheck, and I find that it is $1000 LESS than it had been before. Turns out, on my 3rd anniversary, I got reclassified in the system and now taxes are being deducted when they were not before. Well, shit. I needed that money to move! So, I had to beg money from the parents (I hate doing that), and I was able to refinance the CitiLoan and get an additional $900.

So, to recap. Moving is hard enough as it is without the landlord/rental agent being assholes. Moving is expensive enough even when your job doesnt suddenly stop 1/3 of your pay. And now, all the progress of paying $200+/month to the loan from the therapy has been washed away and theres even more debt. And I had to get money from the parents, which I had not needed to do in years.

The upside, no one is getting shot on my street, and I dont feel unsafe walking to my car after dark at home. And there is a washer and dryer in my apartment. The downside, I now have still more debt and more guilt than before. My rent is $175/month more than before and I make $1000 less/month. Plus, utilities here are more expensive, and now I have to drive to work.

I guess, in the long run, for my piece of mind the safety is most important. But I now have ZERO extra money ever. I am back to where I was financially in 2004, which was pretty shitty. I dont have mountains of credit card debt, but there is that damn CitiLoan still out there. And I have no real money in my savings accounts. I had been hoping that by 2010 things would be less bleak, but it does not appear to be turning out that way.

I am kinda very annoyed with my apartment. All the little things are now glaring blemishes. I hate my downstairs neighbors. I dont like the driving to work. And now I am 100% stuck. There is no way to get more money from the parents (especially after they helped with the vet costs in June). And I doubt that I would be able to get more money out of the CitiLoan. So, I just need to tough it out here until I get my real job in the mythological future.

And there is the added horribleness of having my friends not completely understand the situation. I used to travel 3 or 4 times each year to visit friends or family. Now, I absolutely can not do that. There is no money. I havent been on a trip for almost a year. And there are things that I would love to do. But I am living in a situation of my own creating, and I need to deal with that.

It just sucks you know. On paper, moving was a BAD decision, but is the safety issue and piece of mind (however how small) worth the added financial stress? I dont know. Probably. I really dont think that I could handle that neighborhood now. But it just sucks that I had to ruin my finances to get out of there and that I am not 100% satisfied with my apartment.

Overall, I declare this situation NEUTRAL.

Picture it... crappy neighborhood Fall 2008. (Gold Girls reference, sorry, my gay is showing)....

Anyway, when I moved cross-country in 2005, I knew that I wasnt moving into the greatest of cities or the greatest of neighborhoods in said city. But it was good enough, the place was nice and affordable, and I could take public trans (or walk) to work.

Over my first three years here, I saw the neighborhood slowly decline. The people on my street (more importantly my building and neighbors owned by the same people) were moving away, and apartments were vacant for a long time. The people moving in were not of the same caliber as before. People around my age and situation (grad/med school types) were moving out and poorer families with many children were moving in.

Graffiti appeared on the back of our house. Cars in the back lot were broken into. The landlords put up a fence (it helped some, but was kinda retarded as it didnt actually enclose anything). A car was parked across the street for over a week with no one attending it, and eventually, all the windows were busted out of it. Turns out the car was stolen and abandoned on our street.

One night last October, I was playing video games and chilling out at home, and I heard shouting outside. I looked out the window, and saw a car parked in the middle of the street and two guys shouting at each other. I sat back down and played more games. And then, I heard it. Five or six very loud gunshots right outside my house. I looked out the window and saw one of the guys running off down the street.

I grabbed my phone and called 911. Moments later, police and fire trucks were there. I never really learned what happened that night. No one was killed on my street. But the seed had been placed... it was time to move. The police action took hours. People were yelling, police investigated. I heard one woman shout: Oh my god! Thats my sisters car! What the fuck? What happened?.

The next morning, I told my carpool what happened, and one of my friends responded, with oh just last week so and so told me that someone was shot and killed outside her house. That was a block away at the other end of my street!

That morning, I was on the phone with my landlord trying to get out of my lease. They understood. I had just signed a new lease two weeks earlier, so they were sad, but they did let me out of the lease. I promised to be out by December 1.

What followed was a month of hunting for apartments. That was so NOT easy. Maybe my standards are too high? Maybe this city is not that good in general? Eventually, I found a place that I liked; however, I (again) missed warning signs.

I was so focus on getting out of the ghetto and into a decent place, that I missed a few things. Anyway, I did see the apartment, but it was after dark and most of the lights in the place were burned out. As devils advocate, there are no ceiling lights in most of the apartment. But still, I should have insisted on revisiting in the daytime. But I liked the location and the layout, and they would take my cats. So I said I would apply. The rent was a bit more than I wanted to pay, and I did try to get him to come down on the deposit. But he said he wouldnt if I had the cats. UGH.

Anyway, what followed was a month of drama. Where I had rented apartments before (in a different state), there are very strict laws in place that landlords and tenants MUST follow. And everything is very well standardized and thought out. NOT HERE. First off, what I didnt realize at the time, was that I was dealing with a rental company and NOT the landlord. Their only goal is to rent the property for the landlord, collect their commission, and wash their hands of the whole thing. So, when I saw the apartment, I said it was dirty and needed to be cleaned. The rental agent told me that the landlord would have the place cleaned and painted in time for move in. And I agreed.

I had a meeting to sign the lease, but they didnt have the keys. So, I paid money and had NOTHING to show for it. The next day, I got the keys. But it was not ALL of the keys. I was missing a mailbox key and the key to balcony door (which is double keyed, so until I had a key it could not be LOCKED). After several run arounds with the rental people, I finally go in touch with the landlord. And he insisted that the rental people had all the keys. After assuring him that they did not have all the keys, I had to meet with him at his office (an OB/GYN office, very uncomfortable) during the work day to compare my keys with his keys. Turns out he had some keys that he didnt know what they were, and they were my missing keys.

Anyway, I drive up to check on the place during the day (weeks after I was told the place would be cleaned), and it wasnt. Nothing had been done. I talked with the landlord, and he said If I knew it had to be cleaned, I would have charged more for the deposit. What the fuck!?! That charge should have been made against the pigs that moved out of here.

Anyway, I told him that it didnt matter, because I had already rented a truck to move the next day. So on moving day, I rented a carpet shampooer and my friend (the compulsive cleaner) shampooed and vacuumed and scrubbed while us boys moved boxes from the truck.

So, the financial part come in here. At the same time that Im looking for a new place to live, I get my October 2008 paycheck, and I find that it is $1000 LESS than it had been before. Turns out, on my 3rd anniversary, I got reclassified in the system and now taxes are being deducted when they were not before. Well, shit. I needed that money to move! So, I had to beg money from the parents (I hate doing that), and I was able to refinance the CitiLoan and get an additional $900.

So, to recap. Moving is hard enough as it is without the landlord/rental agent being assholes. Moving is expensive enough even when your job doesnt suddenly stop 1/3 of your pay. And now, all the progress of paying $200+/month to the loan from the therapy has been washed away and theres even more debt. And I had to get money from the parents, which I had not needed to do in years.

The upside, no one is getting shot on my street, and I dont feel unsafe walking to my car after dark at home. And there is a washer and dryer in my apartment. The downside, I now have still more debt and more guilt than before. My rent is $175/month more than before and I make $1000 less/month. Plus, utilities here are more expensive, and now I have to drive to work.

I guess, in the long run, for my piece of mind the safety is most important. But I now have ZERO extra money ever. I am back to where I was financially in 2004, which was pretty shitty. I dont have mountains of credit card debt, but there is that damn CitiLoan still out there. And I have no real money in my savings accounts. I had been hoping that by 2010 things would be less bleak, but it does not appear to be turning out that way.

I am kinda very annoyed with my apartment. All the little things are now glaring blemishes. I hate my downstairs neighbors. I dont like the driving to work. And now I am 100% stuck. There is no way to get more money from the parents (especially after they helped with the vet costs in June). And I doubt that I would be able to get more money out of the CitiLoan. So, I just need to tough it out here until I get my real job in the mythological future.

And there is the added horribleness of having my friends not completely understand the situation. I used to travel 3 or 4 times each year to visit friends or family. Now, I absolutely can not do that. There is no money. I havent been on a trip for almost a year. And there are things that I would love to do. But I am living in a situation of my own creating, and I need to deal with that.

It just sucks you know. On paper, moving was a BAD decision, but is the safety issue and piece of mind (however how small) worth the added financial stress? I dont know. Probably. I really dont think that I could handle that neighborhood now. But it just sucks that I had to ruin my finances to get out of there and that I am not 100% satisfied with my apartment.

Overall, I declare this situation NEUTRAL.

OMG! Its been a long time.

I realized over the course of the last week that I have not posted anything in a while. This afternoon when I got home from work, I actually looked at my blog, and I have not posted in 14 days! Holy crap! Where the frak did the time go? No one out there is more angry with me (with perhaps the exception of SS4BC) than I am. The whole point of having a blog is to write in it. Anyway, I had a thought over the weekend about a post (or series of posts) that I wanted to write. Today seems like as good a time as any to get started on that.

This is what Id like to call Great Financial Decisions in DelMoniq History. And of course, the word great is here meant to simply mean big or important and NOT necessarily GOOD. There have been many more bad decisions in my life than good ones.

So without further ado, lets start off with the decision that started this idea for posts, and hopefully, over the next few days, I can hammer out a few more blog posts to go along with this theme.

I. Going into Therapy

This must be a good decision, since therapy is there to help you and not to hurt you. Oh god, I wish that were the case.

January 2006, I was in such a funk. I had been in funks before off and on over the years, but this was a doozy. I wasnt sleeping well, and I was exhausted all the time. Most days, I would go to work and sit at my desk staring off into space not really doing anything and not really thinking of anything (other than what a mess my life was at the time). Frankly, I was miserable pretty much all the time that I was awake. I drank WAY too much, and I smoked a ton. And I was simply drifting through my life existing and not really living.

Eventually, one of my friends (who by the way is no longer one of my friends, but for completely other reasons; he was definitely one of the great friends of my life, and I am really sad that I only knew him for a year or so)... anyway... this friend told me that I really needed to seek help -- either that or go out and fix myself on my own, either way something needed to be done. I fretted for a long time, and once the sad realization that if left to my own devices things would not change, I decided to seek out a psychiatrist.

The seeking out on its own was probably the hardest thing that I have ever done in my entire life. In total, I saw three different doctors. The first one was simply for the insurance purposes, and he suggested a list of other doctors that I could see. The second doctor that I saw told me (mind you this is after waiting over two weeks for an appointment) that I was going to be too much work for him and he did not have the time to devote to me. So, he recommended me to another doctor. After another week or so of waiting, I saw him. He said that the 2nd doctor was basically an asshole; why have me come for an appointment, if he wasnt going to take me? At least he didnt charge me for anything.

At this point (being a finance blog and all), I should point out that I have paid a grand total of $0 over the month of searching for a doctor. Which, by the way, is probably the most humiliating experience that I have had. The initial visit to a psychiatrist is absolute hell. Anyway, the 3rd doctor that I saw seemed like an okay guy, and there was no way in hell that I was going to try for a 4th.

So, we settled in for a regular weekly appointment, and he prescribed some meds. And for the first few months, things were okay; and I might even say that things were getting better. At least, my friends told me that they thought that I was getting better, even though I didnt feel any better.

The downfall of this therapist was one major thing (aside from the fact that I didnt think that I was getting any better), money. Each 50 minute session cost me $175. The meds I was on were too new for a generic version and that cost about $300/month. And in the beginning, he was nice about it. I collected the bills he sent me, and submitted them to the insurance for reimbursment (even though I had not paid anything) and they gave me $60/visit back and about 80% of the prescription charges. And when I had enough money saved up, I would bring a check with me to my appointment.

Towards the end of my time with this doctor, things were horrible. I wasnt feeling like I was getting better (it had been over a year), and he was irritable, because he wasnt getting paid as often as he would have liked. So it was a stalemate; he would not reduce his charges, and I couldnt scrape together more money to pay. And at the end of the year (maybe 9 months even), the insurance stopped reimbursing me, because I went over the max number of visits per year. So, I was screwed.

Eventually, he told me that if I could get together a lump payment of at least $7000 that he would forgive the rest of my bill (which at this point 18 months in was over $10,000). That was the last I saw of him. I started looking in to ways I could get $7000. And thus, the CitiFinancial personal loan was born. I was approved for $7500. They cut a check for $7000 directly to the doctor, which I mailed to him the next day, and I kept $500 for myself.

I never heard from the doctor again. There was no thank you for paying. There was no are you okay, you missed your last appointment. Nothing. And thats when I knew for sure that I had FINALLY made the right decision of dropping out of therapy. He was a shitty doctor.

So, now (nearly 2 years later), I dont feel much worse off than I did when I quit therapy; I dont feel better, but Ill settle for not worse. And I have $7500 in debt, after a long struggle to get my head above water, I was drowning again.

That, my friends, is Great Financial Decision #1. BAD CHOICE. What did I learn? Well, I used to tell myself that the lesson was that therapy sucks and does not help you at all. But after writing all of this out there, I think that the real lesson is to put in the effort to find a good doctor; do the research and you should be able to find someone that can help you AND work in your budget. The other side of the coin, is being able to say no. Had I thought about it when I started, I would have realized that $175/week was unmanageable, and I would have negotiated when I started, had him recommend someone cheaper, or just not started therapy. But now, I think that this experience has soured me entirely on therapy in general, and now I am just self-learning how to deal with my disorder or whatever you want to call it.

This is what Id like to call Great Financial Decisions in DelMoniq History. And of course, the word great is here meant to simply mean big or important and NOT necessarily GOOD. There have been many more bad decisions in my life than good ones.

So without further ado, lets start off with the decision that started this idea for posts, and hopefully, over the next few days, I can hammer out a few more blog posts to go along with this theme.

I. Going into Therapy

This must be a good decision, since therapy is there to help you and not to hurt you. Oh god, I wish that were the case.

January 2006, I was in such a funk. I had been in funks before off and on over the years, but this was a doozy. I wasnt sleeping well, and I was exhausted all the time. Most days, I would go to work and sit at my desk staring off into space not really doing anything and not really thinking of anything (other than what a mess my life was at the time). Frankly, I was miserable pretty much all the time that I was awake. I drank WAY too much, and I smoked a ton. And I was simply drifting through my life existing and not really living.

Eventually, one of my friends (who by the way is no longer one of my friends, but for completely other reasons; he was definitely one of the great friends of my life, and I am really sad that I only knew him for a year or so)... anyway... this friend told me that I really needed to seek help -- either that or go out and fix myself on my own, either way something needed to be done. I fretted for a long time, and once the sad realization that if left to my own devices things would not change, I decided to seek out a psychiatrist.

The seeking out on its own was probably the hardest thing that I have ever done in my entire life. In total, I saw three different doctors. The first one was simply for the insurance purposes, and he suggested a list of other doctors that I could see. The second doctor that I saw told me (mind you this is after waiting over two weeks for an appointment) that I was going to be too much work for him and he did not have the time to devote to me. So, he recommended me to another doctor. After another week or so of waiting, I saw him. He said that the 2nd doctor was basically an asshole; why have me come for an appointment, if he wasnt going to take me? At least he didnt charge me for anything.

At this point (being a finance blog and all), I should point out that I have paid a grand total of $0 over the month of searching for a doctor. Which, by the way, is probably the most humiliating experience that I have had. The initial visit to a psychiatrist is absolute hell. Anyway, the 3rd doctor that I saw seemed like an okay guy, and there was no way in hell that I was going to try for a 4th.

So, we settled in for a regular weekly appointment, and he prescribed some meds. And for the first few months, things were okay; and I might even say that things were getting better. At least, my friends told me that they thought that I was getting better, even though I didnt feel any better.

The downfall of this therapist was one major thing (aside from the fact that I didnt think that I was getting any better), money. Each 50 minute session cost me $175. The meds I was on were too new for a generic version and that cost about $300/month. And in the beginning, he was nice about it. I collected the bills he sent me, and submitted them to the insurance for reimbursment (even though I had not paid anything) and they gave me $60/visit back and about 80% of the prescription charges. And when I had enough money saved up, I would bring a check with me to my appointment.

Towards the end of my time with this doctor, things were horrible. I wasnt feeling like I was getting better (it had been over a year), and he was irritable, because he wasnt getting paid as often as he would have liked. So it was a stalemate; he would not reduce his charges, and I couldnt scrape together more money to pay. And at the end of the year (maybe 9 months even), the insurance stopped reimbursing me, because I went over the max number of visits per year. So, I was screwed.

Eventually, he told me that if I could get together a lump payment of at least $7000 that he would forgive the rest of my bill (which at this point 18 months in was over $10,000). That was the last I saw of him. I started looking in to ways I could get $7000. And thus, the CitiFinancial personal loan was born. I was approved for $7500. They cut a check for $7000 directly to the doctor, which I mailed to him the next day, and I kept $500 for myself.

I never heard from the doctor again. There was no thank you for paying. There was no are you okay, you missed your last appointment. Nothing. And thats when I knew for sure that I had FINALLY made the right decision of dropping out of therapy. He was a shitty doctor.

So, now (nearly 2 years later), I dont feel much worse off than I did when I quit therapy; I dont feel better, but Ill settle for not worse. And I have $7500 in debt, after a long struggle to get my head above water, I was drowning again.

That, my friends, is Great Financial Decision #1. BAD CHOICE. What did I learn? Well, I used to tell myself that the lesson was that therapy sucks and does not help you at all. But after writing all of this out there, I think that the real lesson is to put in the effort to find a good doctor; do the research and you should be able to find someone that can help you AND work in your budget. The other side of the coin, is being able to say no. Had I thought about it when I started, I would have realized that $175/week was unmanageable, and I would have negotiated when I started, had him recommend someone cheaper, or just not started therapy. But now, I think that this experience has soured me entirely on therapy in general, and now I am just self-learning how to deal with my disorder or whatever you want to call it.

Monday, September 7, 2009

Thinking about stuff.

Yeah, I know that thinking usually gets me in trouble. Mainly because I tend to dwell on things and get all mopey and depressed, just ask my brother. All this work drama has me worried and stressed out, and it has brought about all the old feelings from my former, emotionally abusive boss and how it was when I got fired from that job.

Financially, I have to work. I wish that werent the case (dont we all). But honestly, if were told in my meeting with the boss on Wednesday that I would have to leave in two weeks... I would be royally frakked! I have less than $1000 in my combined savings accounts--not even enough for the next month of rent. The logical, reasonable part of me realizes that chances of me getting fired are slim, but the rest of me knows that there is now a non-zero chance of getting fired.

The boss has told me in the past that I was safe in my position and that I didnt have anything to worry about. [quote]Other people will leave before you do,[/quote] she said. But that was then, and this is now. She said just several weeks ago, when we first learned that the one grant didnt get funded, that no one should worry about his/her job at group meeting in front of everyone. A month later, my good friend is out of a job (and kicked out of school).

She has unwittingly (or perhaps purposefully) and irreversibly altered the mood/state of the lab. Everyone is worried about his/her job. Whether she intended to or not, she has ushered in a regime of fear. This is how my former boss ran his lab. Constantly being told that if you dont produce and publish on his time frame, you will be out.

I find myself forced to consider contingency plans. What would I do? semi-continuously reverberates in my mind. So, what would I do? I would need to find another job, ASAP. However, could I? Four years, one paper, fired for not producing results. Does NOT look good! Top that with the fact that this is my second postdoc position, and I was fired from the first one for...not producing results! Im unemployable -- with the notable exception that I know that SS4BC would hire me if she were running her own lab, but thats a minimum of two years off.

So, what would I do? The only thing I could do, I guess. Sell as much of my shit as I can, rent a truck, and shack up with my parents. Of course, without income, I would be in deep shit to the government for my taxes, and I would default on my loans. None of that will do good things to my credit rating. I would have to find some sort of job close to where my parents are and scrimp and save and figure out what to do.

So, what do I do now? I frakking work my ass off trying my frakking hardest to produce results so as NOT to get fired. And this situation has me frakking scared. I know from experience that this is not a good position to be in with a boss. I have a plan to get shit done, but I have no idea if the boss will agree with my plan. I have a plan to show her what is getting done, but is this going to be enough? How do you convince a boss NOT to fire you when your science isnt working? That is a question that had plagued me for a long time that I was sure I was past.

But I guess not. I just hope to gods that my plans work and that the outlook after Wednesdays meeting is better. Because right now, I am terrified.

Financially, I have to work. I wish that werent the case (dont we all). But honestly, if were told in my meeting with the boss on Wednesday that I would have to leave in two weeks... I would be royally frakked! I have less than $1000 in my combined savings accounts--not even enough for the next month of rent. The logical, reasonable part of me realizes that chances of me getting fired are slim, but the rest of me knows that there is now a non-zero chance of getting fired.

The boss has told me in the past that I was safe in my position and that I didnt have anything to worry about. [quote]Other people will leave before you do,[/quote] she said. But that was then, and this is now. She said just several weeks ago, when we first learned that the one grant didnt get funded, that no one should worry about his/her job at group meeting in front of everyone. A month later, my good friend is out of a job (and kicked out of school).

She has unwittingly (or perhaps purposefully) and irreversibly altered the mood/state of the lab. Everyone is worried about his/her job. Whether she intended to or not, she has ushered in a regime of fear. This is how my former boss ran his lab. Constantly being told that if you dont produce and publish on his time frame, you will be out.

I find myself forced to consider contingency plans. What would I do? semi-continuously reverberates in my mind. So, what would I do? I would need to find another job, ASAP. However, could I? Four years, one paper, fired for not producing results. Does NOT look good! Top that with the fact that this is my second postdoc position, and I was fired from the first one for...not producing results! Im unemployable -- with the notable exception that I know that SS4BC would hire me if she were running her own lab, but thats a minimum of two years off.

So, what would I do? The only thing I could do, I guess. Sell as much of my shit as I can, rent a truck, and shack up with my parents. Of course, without income, I would be in deep shit to the government for my taxes, and I would default on my loans. None of that will do good things to my credit rating. I would have to find some sort of job close to where my parents are and scrimp and save and figure out what to do.

So, what do I do now? I frakking work my ass off trying my frakking hardest to produce results so as NOT to get fired. And this situation has me frakking scared. I know from experience that this is not a good position to be in with a boss. I have a plan to get shit done, but I have no idea if the boss will agree with my plan. I have a plan to show her what is getting done, but is this going to be enough? How do you convince a boss NOT to fire you when your science isnt working? That is a question that had plagued me for a long time that I was sure I was past.

But I guess not. I just hope to gods that my plans work and that the outlook after Wednesdays meeting is better. Because right now, I am terrified.

Thursday, September 3, 2009

Porn. Probably NSFW, but there are no pictures.

A while back, SS4BC posted about Sex and the Wallet, and its a great post about about the cost of things in that arena. And I know that I have a habit of over-sharing (see comments on the linked post, if youre really curious). I assure you that Im not creepy, but I wont be offended if you dont finish reading this post.

Anyway, I was just randomly surfing around online tonight, and went to a great site for buying adult DVDs that I had not visited in a long time. Remember, porn is expensive, and I try NOT to do expensive these days.

Anyway, they are having a sale. Any 5 DVDs for $59.95. Doesnt exactly sound like a sale, but when you think about each DVD alone will cost you $45-60, thats a tremendous savings. Of course, I caved, and bought 5 DVDs. And I know that I probably shouldnt have bought them. I can justify this.

(1) I havent bought any porn in over 2 years.

(2) Buying them individually, I would have easily spent $250. So, I saved about $200. Granted as I would not have bought them at that price, I actually saved nothing. But this is purely me justifying my wrongness here.

So, yeah. I caved on an impulse buy, but in an okay way. And I realize that I should be drawing more of a hardline with myself. But my new DVD rule has curbed a LOT of impulse buying. Plus, its actually kind of fun. I was at Target and Best Buy today, and only spent $30 total. But the fun was in looking at the DVDs. And realizing that a $40 DVD set would need to have over 1200 minutes of content to fit the rule. And its really exciting when you find something that fits the rule. I was able to buy House Season 5 and Big Love Season 2, because they were each under 3 cents/minute. I satisfied my DVD urge, and stayed within the budget. The Big Love sale was a real find, because typically HBO shows are WAY more expensive that your standard DVD set.

Anyhoo, thats that. And again, Ill probably not even bother looking for adult DVDs for another year or so, and itll be even longer until I buy again. But a sale like that is really hard to pass up. Its like buy 1 get 4 free.

Yes yes... justify away, Im still bad for buying any at all.

Anyway, I was just randomly surfing around online tonight, and went to a great site for buying adult DVDs that I had not visited in a long time. Remember, porn is expensive, and I try NOT to do expensive these days.

Anyway, they are having a sale. Any 5 DVDs for $59.95. Doesnt exactly sound like a sale, but when you think about each DVD alone will cost you $45-60, thats a tremendous savings. Of course, I caved, and bought 5 DVDs. And I know that I probably shouldnt have bought them. I can justify this.

(1) I havent bought any porn in over 2 years.

(2) Buying them individually, I would have easily spent $250. So, I saved about $200. Granted as I would not have bought them at that price, I actually saved nothing. But this is purely me justifying my wrongness here.

So, yeah. I caved on an impulse buy, but in an okay way. And I realize that I should be drawing more of a hardline with myself. But my new DVD rule has curbed a LOT of impulse buying. Plus, its actually kind of fun. I was at Target and Best Buy today, and only spent $30 total. But the fun was in looking at the DVDs. And realizing that a $40 DVD set would need to have over 1200 minutes of content to fit the rule. And its really exciting when you find something that fits the rule. I was able to buy House Season 5 and Big Love Season 2, because they were each under 3 cents/minute. I satisfied my DVD urge, and stayed within the budget. The Big Love sale was a real find, because typically HBO shows are WAY more expensive that your standard DVD set.

Anyhoo, thats that. And again, Ill probably not even bother looking for adult DVDs for another year or so, and itll be even longer until I buy again. But a sale like that is really hard to pass up. Its like buy 1 get 4 free.

Yes yes... justify away, Im still bad for buying any at all.

Wednesday, September 2, 2009

A little influx of cash.

Working at a Medical School does have its perks. Theres a lab upstairs from mine that does blood studies. Usually, theyre hired by companies to test their products. Ive done two different studies with them. One was testing a new method for storing platelets ($600 for me!) and the other was testing a new machine for collecting red blood cells ($250 for me!). They told me both times that they love my veins and that they would keep me in mind for future studies.

Well, last week, I got a call in lab from them. It has been over a year since I heard from them, so I had pretty much forgotten about them. But theyre doing another platelet study, and they thought of me. Theyre going to harvest platelets, radiolabel them, put them back into me, and draw blood over a period of about two weeks to check on them. It sounds horrible, but Ive done it before, and its not a big deal. But this study pays $620! Im so down for that. Its basically free money. I can bleed. Plus, its helping science, and thats a good thing.

It starts Sept 10 and goes for about three weeks in total. So, I probably wont see money until October. But seeing as how, it will probably all go to taxes or bills anyway, it doeesnt really matter. The point is, I need to be sure NOT to spend it on THINGS I dont need. Its for paying down debt. And $620 will certainly help with that.

And speaking of cash, SS4BC posted about ways to earn some extra cash, and this has me thinking about finally doing something with my change bucket and rolled up piles of coins. I know it may annoy my friends at BofA, but I have a feeling that in the next week or so, I may be walking in there with a sack full of rolled coins to deposit. Its like she says, every cent counts.

Well, last week, I got a call in lab from them. It has been over a year since I heard from them, so I had pretty much forgotten about them. But theyre doing another platelet study, and they thought of me. Theyre going to harvest platelets, radiolabel them, put them back into me, and draw blood over a period of about two weeks to check on them. It sounds horrible, but Ive done it before, and its not a big deal. But this study pays $620! Im so down for that. Its basically free money. I can bleed. Plus, its helping science, and thats a good thing.

It starts Sept 10 and goes for about three weeks in total. So, I probably wont see money until October. But seeing as how, it will probably all go to taxes or bills anyway, it doeesnt really matter. The point is, I need to be sure NOT to spend it on THINGS I dont need. Its for paying down debt. And $620 will certainly help with that.

And speaking of cash, SS4BC posted about ways to earn some extra cash, and this has me thinking about finally doing something with my change bucket and rolled up piles of coins. I know it may annoy my friends at BofA, but I have a feeling that in the next week or so, I may be walking in there with a sack full of rolled coins to deposit. Its like she says, every cent counts.

Tuesday, September 1, 2009

Worried for the Future

It has been a while since I have posted anything, and I am sorry for that. Lots has been going on. But first I have to say that over the weekend, I spilled grape soda on my laptop. Everything is fine and not sticky. However, the apostrophe key was a casualty of my clumsiness. So bear with me if my contractions looks stupid, and Ill try not to quote anything. I have an external keyboard, but I didnt feel like hooking it up.

Anyway, as for the lots happening... One of my best friends here -- a coworker of mine -- was fired. UGH. The whole thing doesnt make any sense, and no one understands what the boss was thinking. Hes a graduate student, and what this essentially means is that he has been kicked out of school. The reasoning -- the boss doesnt think that he will accomplish enough to graduate in a soon enough time frame. Given that he has a max of three years left (plenty of time, in my opinion), this is pretty much a slap in the face.

Needless to say tensions were running high in lab today. And, as apparently the go-to guy in lab, people were coming to me expressing worry for their own positions. Basically, now everyone is worried that if he/she doesnt get enough results in enough time (enough being an arbitrary and subjective quantity defined by the boss) that he/she will be fired (or kicked out of school). Its ludicrous! This is really NOT the tone she needs to set for the lab. But whatever, its done. My friend will be out of work in a couple weeks and will most likely be moving out of state before Christmas.

This is especially mind bottling (yes, I said that on purpose. See Blades of Glory.) in light of the fact that this summer, she took on a new graduate student, and she is seriously a waste of space. Its going to be interesting, as she is presenting for lab meeting this week.

I am just seriously pissed at all of this. And I am dying to know the bosss side of things. Part of me thinks that I can get away with talking to her about it by coming at it from the point of view of the person who will be in her position and wanting to know how she came to this decision. I really will need to know how to know when to cut a graduate student out. But I dont know if shell tell me anything or not. I think that Im just going to wait until my next scheduled one-on-one meeting with the boss next week.

Of course, having been fired from a job for not bringing in enough results, I know how my friend feels, and of course, I too am worried about my job here. I know that the boss has told me in the past NOT to worry about my job and that other people would be let go before me, if need be. But still Im worried. And I would start applying for jobs now, if I had ANY chance of being able to get one. Alas, it comes down to getting results. And while, Ive worked my ass off in this lab, I only have one publication from my nearly 4 years here. Thats not enough. Mostly, this is because my original project was a bust, and I spent 2.5 years or so on it trying to get it to work. Its only been in the last year that Ive had something going that was literally crapping results. Ive just been working on getting a story together. If all goes well, Ill have something written up by the end of the year.

Anyway, I digress.

All this worry has me thinking tonight about where Id like to go. I have an idea job in mind. Of course, I think Id like to be a PI and run my own lab. But when it comes down to it, I dont think thats what Id really like to do. I LOVE doing science. Sure, I have ideas, and I can write about science. But the more I realize what my PIs have done and are doing, the less I actually WANT that job. I like getting my hands dirty in the trenches. I like working one-on-one with students in the lab and teaching lab skills and DOING experiments.

On the other side of the coin is my good buddy, SS4BC. She loves going to conferences, talking to people, networking, writing grants, and such. Sure, shes a fabulous chemist and a great experimentalist. But she was BORN to be a PI. And she has great ideas, and I know that shell do great things with them. And half-jokingly, half-seriously, weve talked about working together. I think that as a team, wed be UNSTOPPABLE. Can we make this work? Is she as serious about it as I am? I dont know. I think that our timing may just work out.

Shes on track to be done with her current position in two years, and shell be looking for faculty positions during that time. So, in theory, shell be on her own by Fall 2011. Given how much slower my experiments are than hers (seriously, Ive been prepping for my big experiment since June and its going to take about 6-8 months to DO the experiment), Ill probably be job-ready about the time she starts a faculty position. Hmmm. This could work.

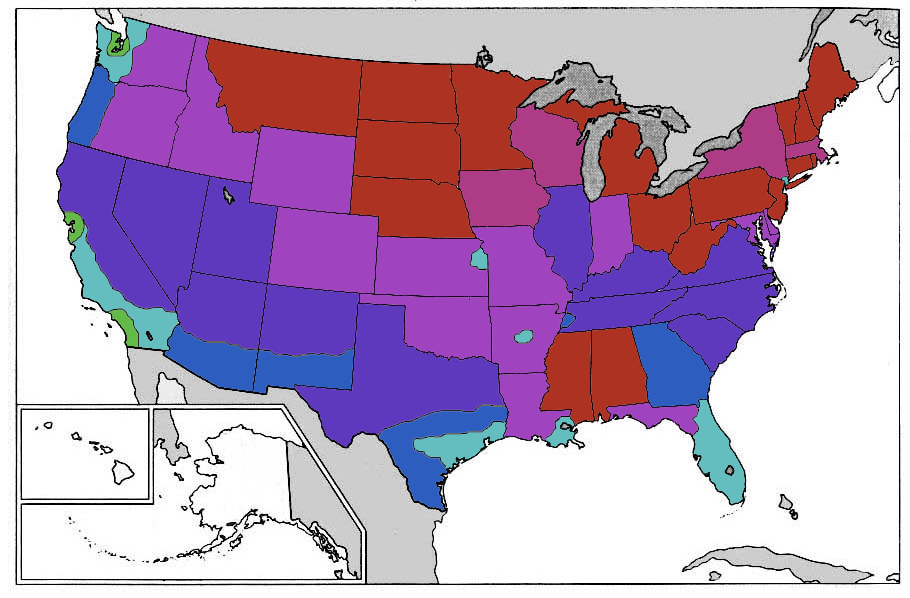

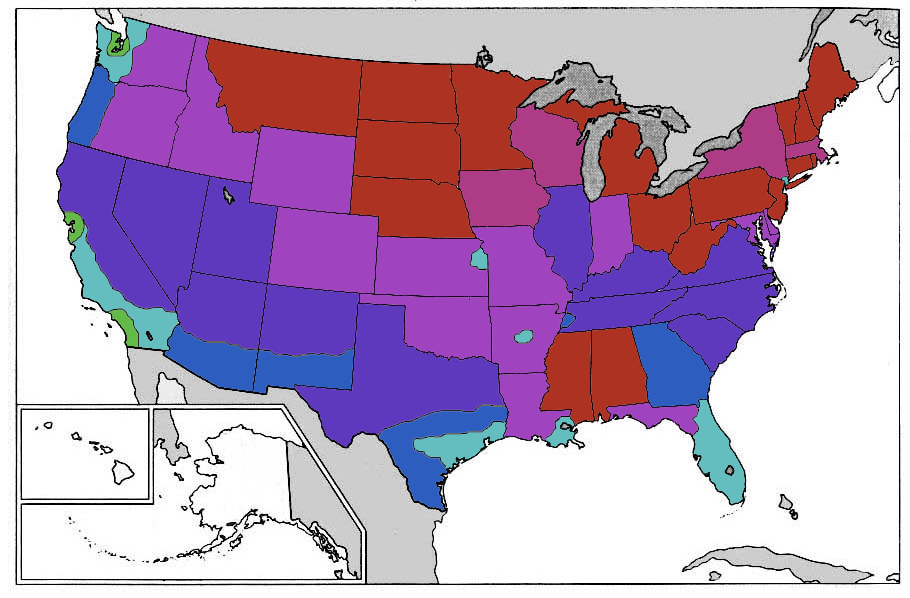

So, what I was thinking about tonight was this: in an idea world, where would I want to live and settle down? And being the map-geek that I am, I made a color coded map to indicate my preferences.

Its color coded from Green to Red (Most to Least Desirable, respectively). Blue falls in the middle. Yeah, Im sure it looks a bit odd to most people, but Ive got my reasons. Do you live an Okturn-Desired area? What do you think? Am I being too judgmental? Im not saying that Id ONLY look for jobs in Seattle, San Francisco, Los Angeles, and San Diego. Im just saying that if two identical jobs were offered in LA or New Jersey, Id take the job in LA. If the perfect job for me is in Montana, so be it. But Id like to stay in more greener pastures (so to speak).

Anyway, it breaks down like this... Living in CT has taught me that (1) I HATE Winter and (2) I HATE New England. So, places guaranteed snow...OUT. (except for NYC, because its a big city and I wouldnt have to drive). Im a CA boy at heart, and I LOVE SoCal and San Francisco. Ive got friends in SoCal Seattle, Georgia, Florida, South Texas, and family in Kansas and Arkansas, and it would be nice to be closer to them. Pretty much the rest is weather based or based on some arbitrary idea that I have about the area.

Anyway, as for the lots happening... One of my best friends here -- a coworker of mine -- was fired. UGH. The whole thing doesnt make any sense, and no one understands what the boss was thinking. Hes a graduate student, and what this essentially means is that he has been kicked out of school. The reasoning -- the boss doesnt think that he will accomplish enough to graduate in a soon enough time frame. Given that he has a max of three years left (plenty of time, in my opinion), this is pretty much a slap in the face.

Needless to say tensions were running high in lab today. And, as apparently the go-to guy in lab, people were coming to me expressing worry for their own positions. Basically, now everyone is worried that if he/she doesnt get enough results in enough time (enough being an arbitrary and subjective quantity defined by the boss) that he/she will be fired (or kicked out of school). Its ludicrous! This is really NOT the tone she needs to set for the lab. But whatever, its done. My friend will be out of work in a couple weeks and will most likely be moving out of state before Christmas.

This is especially mind bottling (yes, I said that on purpose. See Blades of Glory.) in light of the fact that this summer, she took on a new graduate student, and she is seriously a waste of space. Its going to be interesting, as she is presenting for lab meeting this week.

I am just seriously pissed at all of this. And I am dying to know the bosss side of things. Part of me thinks that I can get away with talking to her about it by coming at it from the point of view of the person who will be in her position and wanting to know how she came to this decision. I really will need to know how to know when to cut a graduate student out. But I dont know if shell tell me anything or not. I think that Im just going to wait until my next scheduled one-on-one meeting with the boss next week.

Of course, having been fired from a job for not bringing in enough results, I know how my friend feels, and of course, I too am worried about my job here. I know that the boss has told me in the past NOT to worry about my job and that other people would be let go before me, if need be. But still Im worried. And I would start applying for jobs now, if I had ANY chance of being able to get one. Alas, it comes down to getting results. And while, Ive worked my ass off in this lab, I only have one publication from my nearly 4 years here. Thats not enough. Mostly, this is because my original project was a bust, and I spent 2.5 years or so on it trying to get it to work. Its only been in the last year that Ive had something going that was literally crapping results. Ive just been working on getting a story together. If all goes well, Ill have something written up by the end of the year.

Anyway, I digress.

All this worry has me thinking tonight about where Id like to go. I have an idea job in mind. Of course, I think Id like to be a PI and run my own lab. But when it comes down to it, I dont think thats what Id really like to do. I LOVE doing science. Sure, I have ideas, and I can write about science. But the more I realize what my PIs have done and are doing, the less I actually WANT that job. I like getting my hands dirty in the trenches. I like working one-on-one with students in the lab and teaching lab skills and DOING experiments.

On the other side of the coin is my good buddy, SS4BC. She loves going to conferences, talking to people, networking, writing grants, and such. Sure, shes a fabulous chemist and a great experimentalist. But she was BORN to be a PI. And she has great ideas, and I know that shell do great things with them. And half-jokingly, half-seriously, weve talked about working together. I think that as a team, wed be UNSTOPPABLE. Can we make this work? Is she as serious about it as I am? I dont know. I think that our timing may just work out.

Shes on track to be done with her current position in two years, and shell be looking for faculty positions during that time. So, in theory, shell be on her own by Fall 2011. Given how much slower my experiments are than hers (seriously, Ive been prepping for my big experiment since June and its going to take about 6-8 months to DO the experiment), Ill probably be job-ready about the time she starts a faculty position. Hmmm. This could work.

So, what I was thinking about tonight was this: in an idea world, where would I want to live and settle down? And being the map-geek that I am, I made a color coded map to indicate my preferences.

Its color coded from Green to Red (Most to Least Desirable, respectively). Blue falls in the middle. Yeah, Im sure it looks a bit odd to most people, but Ive got my reasons. Do you live an Okturn-Desired area? What do you think? Am I being too judgmental? Im not saying that Id ONLY look for jobs in Seattle, San Francisco, Los Angeles, and San Diego. Im just saying that if two identical jobs were offered in LA or New Jersey, Id take the job in LA. If the perfect job for me is in Montana, so be it. But Id like to stay in more greener pastures (so to speak).

Anyway, it breaks down like this... Living in CT has taught me that (1) I HATE Winter and (2) I HATE New England. So, places guaranteed snow...OUT. (except for NYC, because its a big city and I wouldnt have to drive). Im a CA boy at heart, and I LOVE SoCal and San Francisco. Ive got friends in SoCal Seattle, Georgia, Florida, South Texas, and family in Kansas and Arkansas, and it would be nice to be closer to them. Pretty much the rest is weather based or based on some arbitrary idea that I have about the area.

Subscribe to:

Posts (Atom)